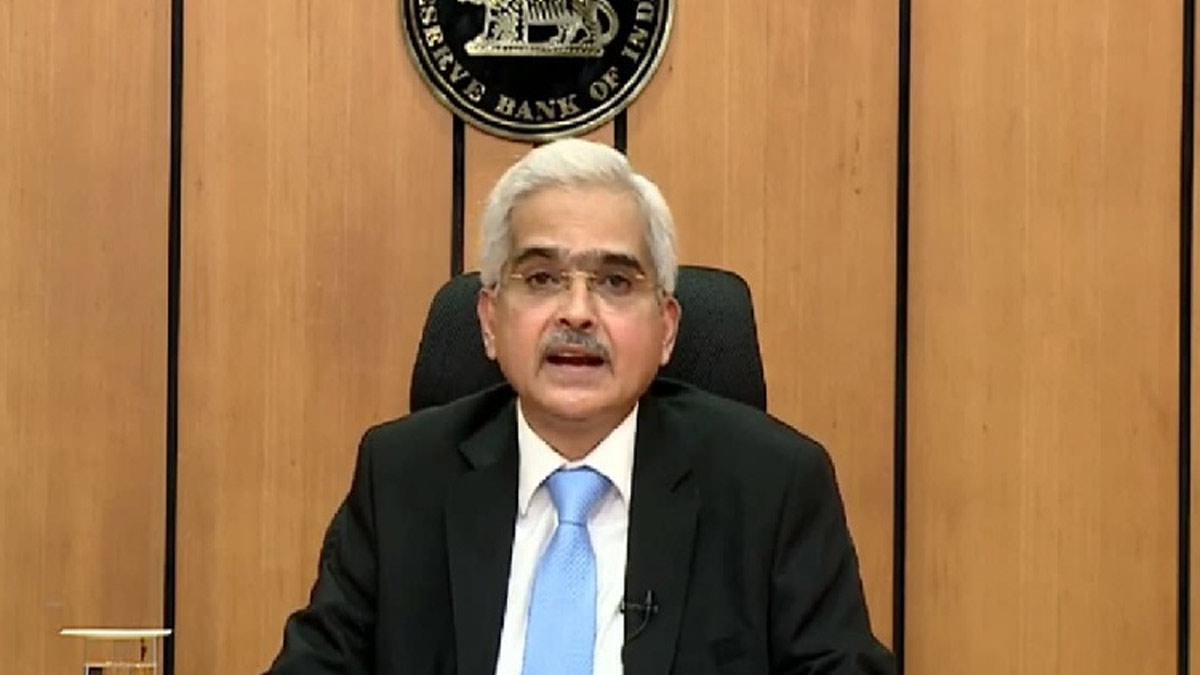

The RBI governor, Shaktikanta Das, said that the Indian economy is strong enough to handle any adverse fallout from global events. "Today, the growth of the Indian economy presents a picture of stability and strength," Das said while addressing an event at the launch of the Kochi International Foundation here.

Again, the external sector of the country is also not too weak and the current account deficit has remained within manageable limits as it presently stands at 1.1 percent of GDP.

Earlier it was in the range of six to seven percent during 2010 and 2011, he added. The Central bank chief also cautioned that India has one of the largest foreign exchange reserves in the world at about $675 billion.

He further said the inflation in the country will be moderate despite periodic humps. India's inflation rose to 6.2 percent in October from 5.5 percent in September because of food inflation, he added. Reiterating that this is the elephant in the room, Das said: "Now the elephant has gone out of the room for a walk, then it will go back to the forest.".

He also highlighted that when the war in Ukraine started, inflation bounced up but the RBI did the appropriate monetary policy unlike some other countries, and could cap the price spiral. "What we did not do in India is also important.

RBI did not print notes because if we start printing notes the problems we are trying to resolve will expand and go beyond handling," he said. In many countries, inflation was deep-rooted but ours is moderating, he added.

We kept our interest rate 4 per cent, therefore making our recovery much easier, he pointed out. Das also highlighted how the RBI is bringing about a transformational change in credit delivery, especially to small entrepreneurs and farmers, through the Unified Payments Interface (UPI) and the Unified Lending Interface (ULI) launched recently.

Read also| Automobile Retail Sales Rise 12% to 42.88 Lakh Units During Festive Period: FADA

Read also| Samsung Announces $7.16 Billion Stock Buyback to Enhance Shareholder Value