Gold prices have the potential to touch a record high of $3,300 per ounce by 2025, as per a recent report, propelled by concerns over weakening economic growth in the US, rising geopolitical tensions, and expanding fiscal deficits.

The report, put together by Capitalmind Financial Services Private Limited, states that these concerns have revived demand for gold as a safe asset, especially when equity markets see a correction.

The report highlights that gold has been a consistent and reliable asset for Indian investors throughout the years. Irrespective of the ups and downs in international markets, gold has always yielded positive returns when calculated in Indian rupees (INR).

Interestingly, the report highlights that gold has never recorded negative returns for a decade in INR terms, while it has experienced two decades of losses in US dollar (USD) terms.

Anoop Vijaykumar, Capitalmind's Head of Research, explained that gold plays a dual role: it is a long-term value store but also a highly volatile asset subject to short-term price fluctuations.

To Indian investors, the decline of the rupee against the dollar has turned gold into a progressively more popular choice as a safer investment.

"Gold may not provide cash flows or compound like stocks, but its low correlation with other assets makes it an essential tool for diversification," Vijaykumar added.

He further suggested that the best strategy for incorporating gold into an investment portfolio is through systematic rebalancing. This means regularly adjusting gold holdings as part of a long-term approach, rather than reacting impulsively to market movements.

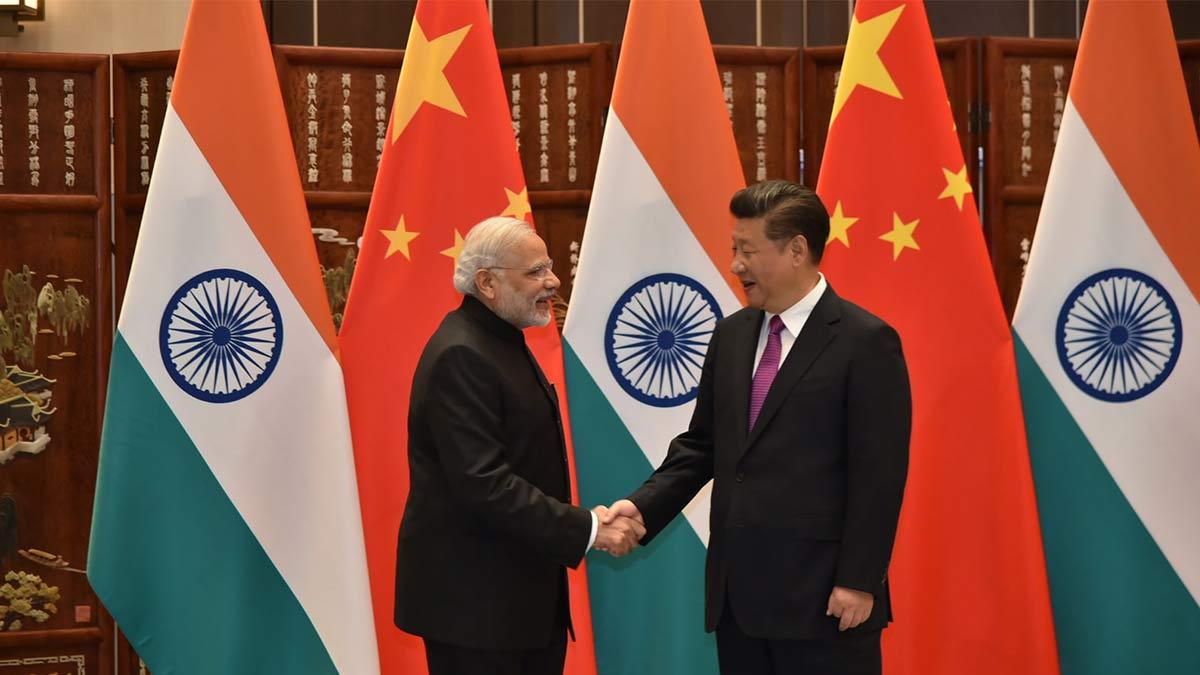

The report also identifies the main drivers for the recent spike in gold prices. Among them has been the continued trade war between China and the US. The US putting high tariffs on Chinese imports and Chinese retaliation have led investors to seek safe-haven assets like gold.

Analysts have linked an $800 per ounce rise in gold prices in 2024 to these trade tensions. In addition, the weakening of the Chinese yuan has also helped raise gold demand, the report says.

Read also| India Among First in Line for Trade Deal, Says US Treasury Secretary

Read also| India’s Industrial Output Grows by 3% in