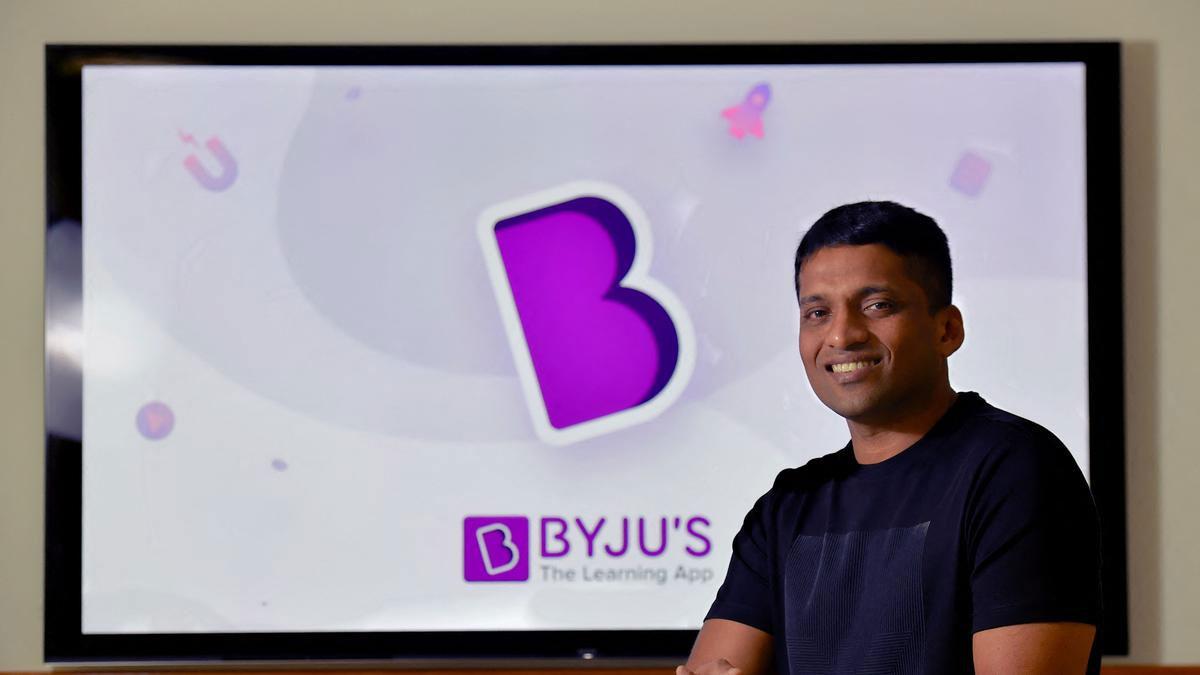

In a dramatic turn of events, the majority of Byju's shareholders convened on Friday to vote for the removal of founder CEO Byju Raveendran and his family from the board, citing allegations of mismanagement and failures within the once-revered Indian tech startup. However, the company swiftly rebuffed the outcome, dismissing the vote conducted in the absence of the founders as null and void.

Founder CEO Byju Raveendran, alongside his wife and brother—the sole members of the company board—opted to abstain from the extraordinary general meeting (EGM) orchestrated by a coalition of six investors, collectively holding over 32% stake in Think & Learn (T&L), the parent entity operating the online tutoring platform Byju's.

Despite the founders' absence, over 60% of the shareholders lent their support to all seven resolutions proposed, encompassing the removal of current management, restructuring of the board, and initiation of a third-party forensic investigation into the company's acquisitions.

Prosus, among the investors spearheading the EGM, affirmed that "shareholders unanimously passed all resolutions," highlighting the imperative for resolving governance lapses, financial mismanagement, and compliance concerns at Byju's. However, the EGM encountered a brief delay as approximately 200 attendees, including some of Byju's employees, attempted to join the virtual assembly.

Following meticulous scrutiny, only 40 representatives of the investors were granted access to participate in the voting process. Nonetheless, the ramifications of the EGM await adjudication until March 13, pending a hearing at the Karnataka High Court, where Raveendran challenges the investors' initiative.

While the High Court declined to halt the EGM, it stipulated that the resolutions remain in abeyance until the subsequent hearing. With Raveendran and family holding a substantial 26.3% stake in the company, Byju's preemptively invalidated the resolutions, decrying the proceedings as a challenge to the rule of law.

Ahead of the EGM, four of the six investors lodged an oppression and mismanagement suit against the company's management, seeking a declaration of the founders' incompetence, appointment of a new board, nullification of the recent rights issue, and a forensic audit of financial records.

Byju's spokesperson refuted claims of receiving any formal notification regarding the lawsuit, emphasizing the necessity of adhering to due process. Concurrently, the company underscored procedural irregularities and deficiencies, asserting the invalidity of the resolutions passed by a select cohort of shareholders.

Citing Articles of Association (AoA), Byju's contended that the absence of founder-directors precluded the establishment of a valid quorum, rendering the resolutions null and void. Notably, only a fraction of shareholders participated in the purported EGM.

The founders denounced the EGM as a media spectacle orchestrated by a minority of shareholders pursuing a self-serving agenda. Emphasizing the non-binding nature of the resolutions, Byju's rebuffed any imposition of obligations on the company or its directors.

In parallel, investors petitioned for a forensic audit, echoing their plea before the NCLT for the management's removal, appointment of a new CEO and board, and safeguarding investor rights against prejudicial corporate actions.

Signed by prominent investors including Prosus, GA, Sofina, and Peak XV, the petition garnered additional support from Tiger and Owl Ventures. Amidst the turbulence, Byju's grappled with other setbacks, including auditor resignations, bankruptcy proceedings initiated by lenders against a holding company, and a legal dispute in the US concerning loan terms and repayment.

From its pinnacle valuation of USD 22 billion in 2022, Byju's witnessed a staggering decline, with a recent rights issue valuing the company at a mere USD 200 million.

Read also | 500 Stocks Surpass $1 Billion Market Cap Mark, Nearly Doubling Since 2019

Read also | Byju Raveendran and Board Members to Skip BYJU's Special Shareholder EGM