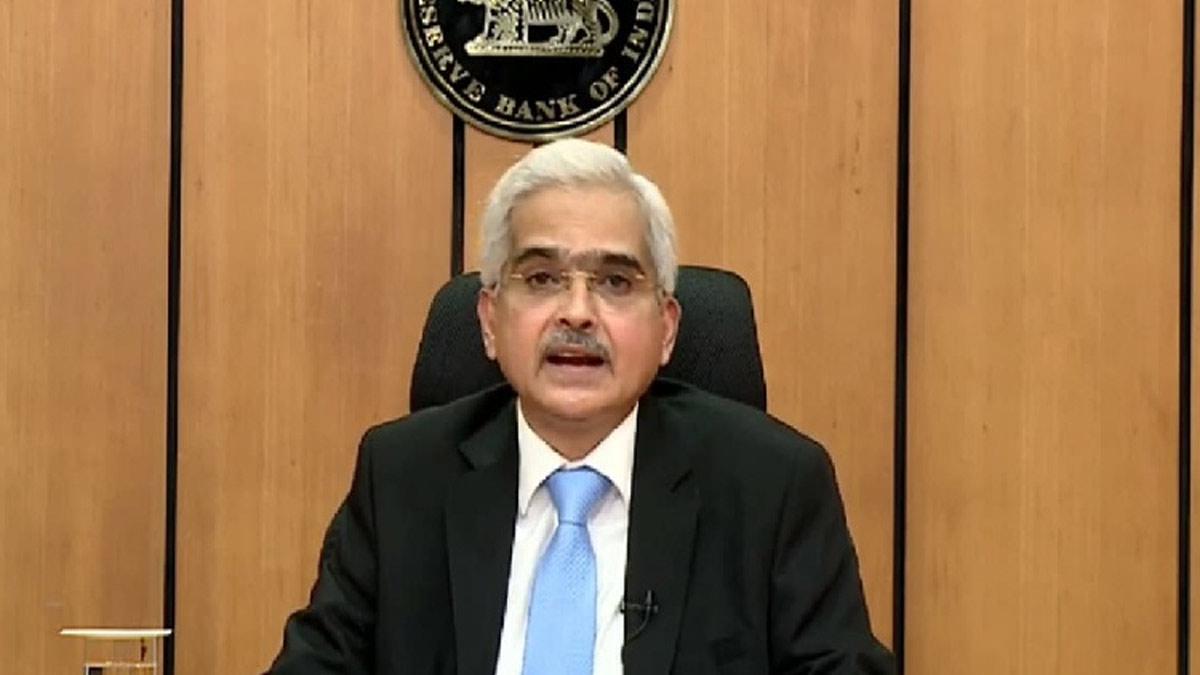

India's growth story remains largely intact as its underpinning drivers-consumption and investment demand-continue building up and, as we know, are gaining momentum as per RBI Governor Shaktikanta Das believes the country shall see a 7.2% real GDP for FY2024-25.

Private consumption - the pivot on which aggregate demand turns - prospects look bright going forward supported by a better agricultural outlook and rural demand.

This should also maintain buoyancy in services. Government expenditure of the centre and the states is likely to gain momentum in consonance with the Budget Estimates," Das said in the RBI's monthly bulletin.

"Consumer and business optimism, government's continued thrust on capex and healthy balance sheets of banks and corporates will also provide support to investment activity, he added.

Considering all these factors, the projection for real GDP growth for 2024-25 is at 7.2 per cent with Q2 at 7.0 per cent; Q3 at 7.4 per cent; and Q4 at 7.4 per cent. The RBI document has projected real GDP growth for Q1 2025-26 at 7.3 per cent.

Meanwhile, the inflationary trends as measured by the CPI are expected to range at 4.5 per cent for 2024-25 and are projected at the following: Q2 at 4.1 per cent; Q3 at 4.8 per cent; and Q4 at 4.2 per cent. For Q1 2025-26, the inflation is projected at 4.3 per cent.

The CPI print for September will see a big jump, partly because of unfavorable base effects and partly because food prices have continued to pick up speed-their impulsion coming from carryover effects from 2023-24 of a modest shortfall in the production of onion, potato and chana dal-gram, amongst others," Das said.

According to the RBI Governor, however, domestic growth in the Indian economy had been sustainable. He noted that growth in private consumption and investment was sustained.

Resilient growth provides space for a focus on inflation so as to ensure its durable descent to the 4 per cent target. Considering the prevailing conditions of inflation and growth and the outlook, it was deemed appropriate by the MPC to shift the stance to 'neutral' and remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth, he noted.

The Reserve Bank will be nimble and adaptable in its liquidity management operations going ahead.

"We will use an optimal mix of instruments to control frictional as well as durable liquidity so that the money market interest rates develop in a credible and sustainable manner," Das said.

Read also| Indian Stock Market Opens in the Green, Sensex Jumps 429 Points

Read also| NSE Study Projects 11.2% Average GDP Growth for 21 Indian States in FY25