Headline inflation is expected to be at about 4% during the current financial year (FY26), down from 4.6% during FY25, as per a recent report by Crisil released on Friday.

The declining trend in inflation can open the door for another potential repo rate cut by the Reserve Bank of India (RBI), above and beyond the cumulative 100 basis points reduction already made, the report noted.

The Consumer Price Index (CPI) recorded a significant dip in May, falling to 2.8%—the lowest it has been since February 2019—compared to 3.2% in April, led by an ongoing drop in food prices.

The report also highlighted a moderation in both fuel and core inflation. Food inflation dipped sharply to just 1% in May from 1.8% the previous month—the lowest it has been since October 2021. Meanwhile, fuel inflation eased slightly, registering 2.8% compared to April’s 2.9%.

Core inflation also declined, dropping to 4.18% in May from 4.23% in April. It has continued to be below the long-term trend of 4.9%, with reference to the decade's average.

Piecing together food inflation's components, the report observed that pulses, vegetables, and spices witnessed deflationary trends, with cereal inflation easing off.

Crisil Intelligence & Research's just-released Thali Index also reinforced this trend, indicating that the price of both vegetarian and non-vegetarian food during May declined by 6% on a year-on-year basis. The decline was mostly due to declining vegetable prices.

A positive crop outlook is also likely to help keep food prices in check. The Ministry of Agriculture's Third Advance Estimates foresee a robust rabi output, with production of wheat crossing a new high.

Further, the India Meteorological Department (IMD) has predicted an above-normal monsoon this year with an estimated rainfall of 106% of the Long Period Average (LPA). "The rains would have a positive effect on the coming kharif season," the report added.

Though, it warned that the monsoon's pace in June has decreased, with total rainfall over the nation lagging 34% behind the LPA. Nevertheless, July and August remain the months considered vital for kharif crop results.

On the energy front, on the assumption that geopolitical tensions do not escalate any further, prices of Brent crude oil are expected to stay in check, between $65 and $70 per barrel for the remainder of the year.

This would deliver additional succor on the non-food inflation front, the report further stated.

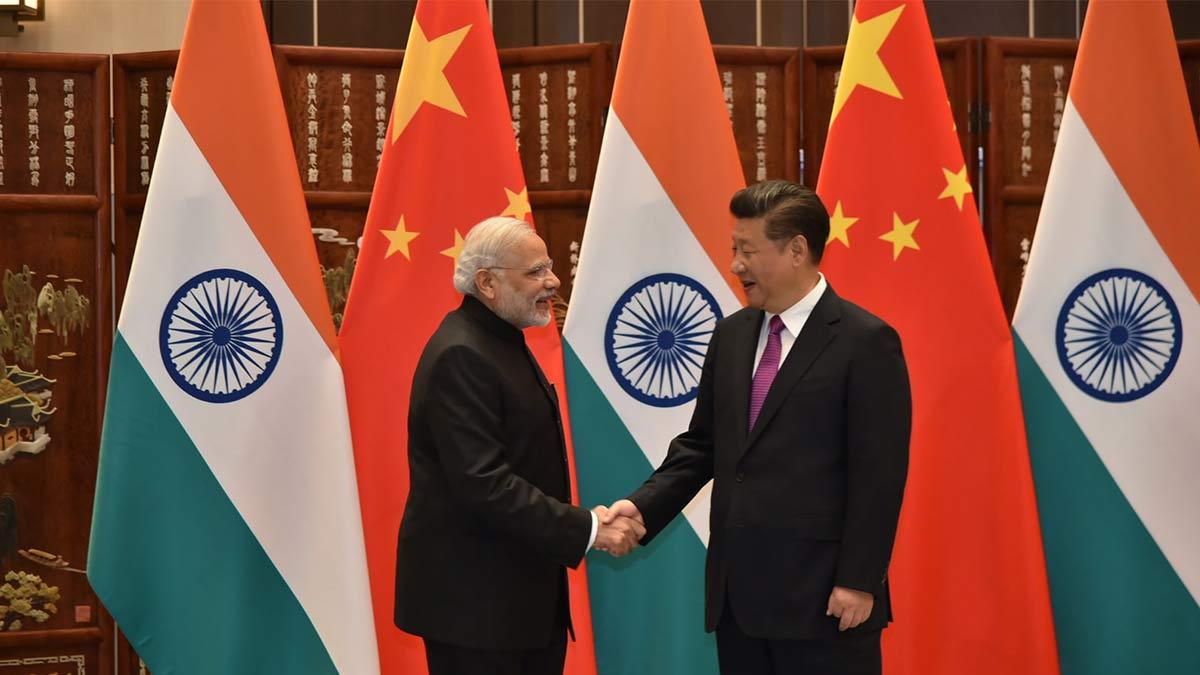

Read also| India Pursues Strategic Engagement with China on Rare Earths, Says MEA