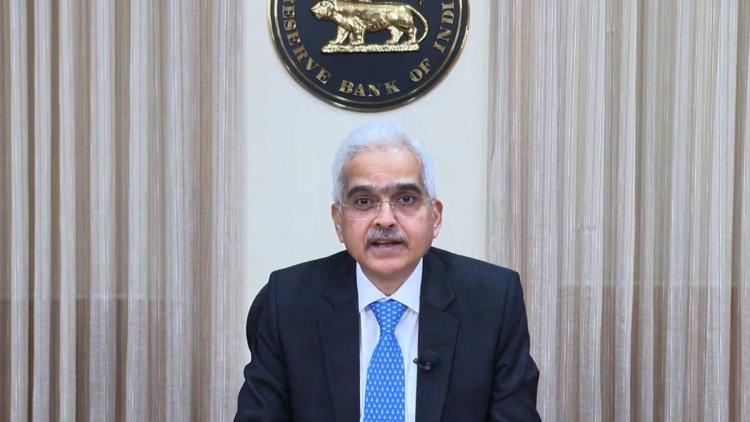

Shaktikanta Das, the Governor of the Reserve Bank of India, expressed significant concern regarding the substantial concentration of credit that Non-Banking Financial Companies (NBFCs) are obtaining from banks to support their lending activities. This trend, according to Das, poses a risk within the financial system.

During the FIBAC 2023 conference, Das emphasized the necessity for NBFCs to diversify their funding sources, reducing their reliance on banks to mitigate the risks associated with interconnectedness.

He highlighted a growing dependence on algorithms by many lenders for decision-making, stressing the importance of a more meticulous analysis of data before investment decisions are made.

Additionally, Das flagged the issue of excessively high interest rates in microfinance, advocating for greater transparency and the avoidance of what he referred to as "usurious" interest rates. This move, he suggested, would help foster economic growth.

While acknowledging the potential for growth and opportunities in India, Das encouraged businesses and financial entities to capitalize on these opportunities by investing in capacity expansion, skill development for human resources, and adopting new technologies.

He concluded by suggesting that the current period presents an opportune moment for India, urging stakeholders to seize this moment for the country's advancement.

(With Agency Inputs)

ALSO READ | RBI Permits Banks to Establish Special Accounts to Aid Exporters in Rupee Trade

ALSO READ | RBI Increases Risk Weightage to 125% for Banks, NBFCs' Consumer Credit