After a stellar opening of its stocks on Wednesday, lifestyle-focused consumer technologies platforms Nykaa's market capitalisation crossed over Rs 1 lakh crore at the end of the day's trade.

Listed at Rs 2,001 at the opening bell, the scrip, as against the offer price of Rs 1,125, went to touch a high of Rs 2,248. It closed at Rs 2,206.70.

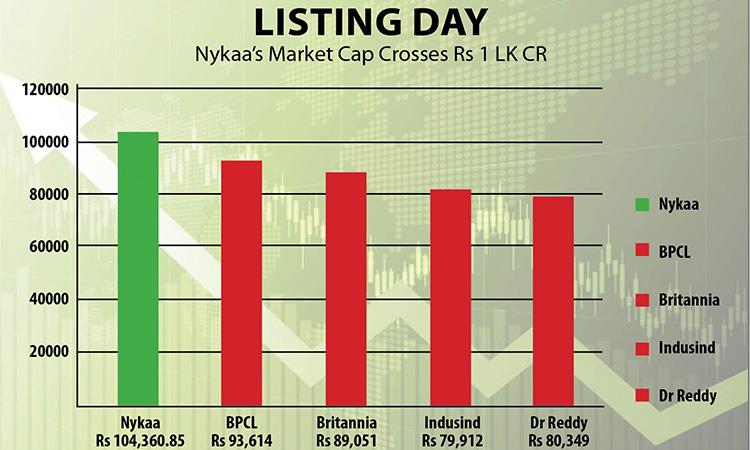

Consequently, the market cap of FSN E-Commerce Ventures, which owns Nykaa, stood at 104,360.85 crore. At present, the promoter family holds around 53 per cent stake in the firm.

Also Read | Nykaa's founder Falguni Nayar is no stranger to India Inc

In comparison, the market cap of BPCL stood at Rs 93,614 crore, Britannia Inds at Rs 89,051 crore, Dr Reddy's Lab at Rs 80,349 crore and IndusInd Bank at Rs 79,912 crore.

According to Elara Capital: "Nykaa is likely to trade at a huge scarcity premium versus global peers in the online BPC space. We believe Nykaa could trade at one-year forward EV/sales of '6-8x', purely based on its core BPC offering."

Motilal Oswal Securities said: "We like Nykaa given its leadership position in online BPC market, customer centric approach and profitable tech platform and capital efficient business model.

Also Read | NBFC collections for securitised retail pools remain steady

"The issue is valued at '16.1x FY22 EV/Sales' on a post issue and annualised basis, which seems to be similar to other Indian unicorns. We believe Nykaa is rightly placed to tap the high growth digital oronline penetration in BPC or fashion market."