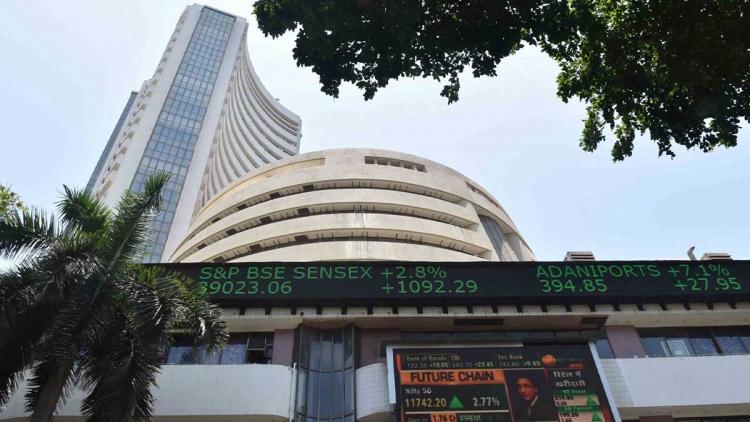

On Friday, the BSE Sensex achieved a milestone by surpassing the 71,000 points mark, fueled primarily by robust performances from heavyweight IT stocks.

The BSE Sensex experienced a notable surge, climbing 559 points to reach 71,108 points. Among the standout performers within the Sensex were IT stocks, with HCL Tech exhibiting a 5 percent increase, Infosys and TCS both rising by 4 percent, and Tech Mahindra recording a 3 percent uptick. Tata Steel also demonstrated a notable growth of 3 percent.

According to V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, the market is anticipated to undergo a consolidation phase following the earlier surge in the first half of the month. However, positive news developments and strategic buying during declines may help maintain resilience in the market.

One of the significant factors supporting the market is the substantial drop in the US bond yield, with the 10-year yield hovering around 3.95 percent. This has triggered substantial capital inflows into emerging markets like India, creating a robust tailwind for the market.

Vijayakumar emphasized that since large-cap financials and IT sectors are reasonably valued and have remained favorites among Foreign Institutional Investors (FIIs), these segments are likely to sustain their positive performance. As the market dynamics evolve, these insights provide a snapshot of the factors influencing the current trajectory of the BSE Sensex.

(With Agency Inputs)

Read also| Sensex Witnesses Over 200-Point Drop as IT Heavyweights Lag Behind: Market Update

Read also| Sensex Surges Beyond 70,000 Mark Following Dovish Message from US Fed