India's foreign exchange reserves have continued their upward trajectory, reaching an unprecedented milestone of $645.58 billion by the conclusion of the week ending March 29, as per data released by the Reserve Bank of India (RBI) on Friday.

The surge in the forex kitty amounted to $2.95 billion for the week, marking the sixth consecutive week of growth following a notable increase of $26.5 billion over the preceding five weeks.

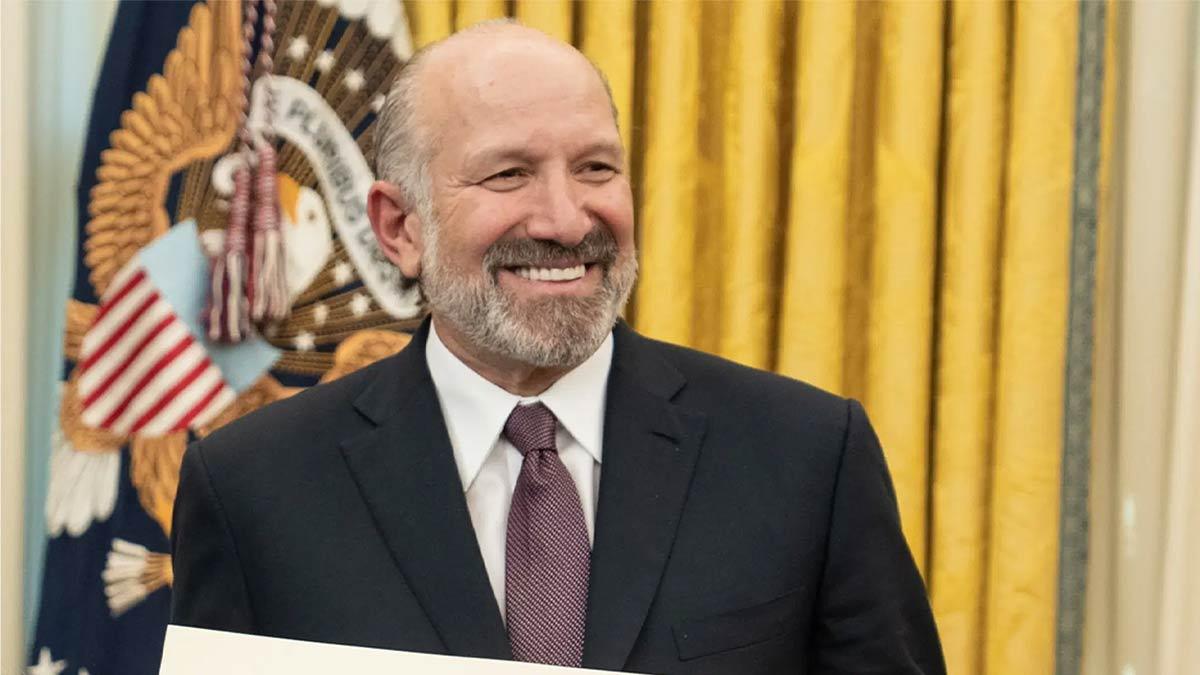

RBI Governor Shaktikanta Das hailed the record-breaking foreign exchange reserves as a testament to the robustness of the Indian economy. "Our primary objective is to fortify our defenses by amassing a substantial reservoir of forex reserves, serving as a bulwark against economic downturns or turbulent times," Das remarked during the unveiling of the initial monetary policy review for the ongoing fiscal year.

The escalating foreign exchange reserves serve as a bullish indicator for the economy, denoting a plentiful supply of dollars that bolsters the value of the rupee. Augmented reserves afford the RBI greater flexibility to stabilize the rupee in the face of volatility. The central bank achieves this by injecting additional dollars into the spot and forward currency markets, thwarting any precipitous declines in the rupee's value.

Conversely, a diminishing forex reserve pool constrains the RBI's ability to intervene effectively in the market to buoy the rupee.

Presently, India's forex reserves, inclusive of the central bank's forward holdings, are adequate to cover over 11 months of imports, nearing a zenith not witnessed in nearly two years.

Governor Das also underscored that the rupee has exhibited notable stability compared to its counterparts in emerging markets and certain advanced economies throughout the 2023-24 period. Notably, it stood out as the most stable major currency during this timeframe.

"The rupee's depreciation by a mere 1.4 percent against the US dollar in 2023-24 pales in comparison to the fluctuations observed in emerging market currencies such as the Chinese yuan, Thai baht, Indonesian rupiah, Vietnamese dong, and Malaysian ringgit, as well as currencies of select advanced economies like the Japanese yen, Korean won, and New Zealand dollar," highlighted Das.

Regarding the rupee's future trajectory, the monetary policy report indicated fluctuation within the range of Rs 82.8-83.4 per US dollar, reflecting a dynamic exchange rate scenario.

Read also | RBI Maintains Steady Repo Rate of 6.5% for Seventh Consecutive time

Read also | RBI Approves Third-Party UPI Apps for Transactions via PPI Wallets