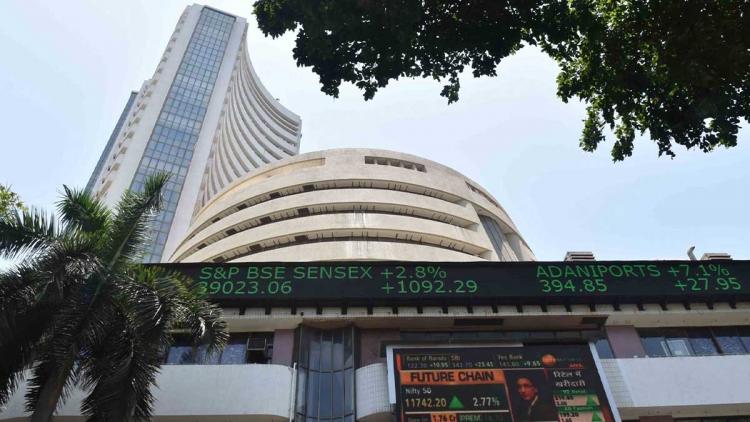

In a notable shift, Foreign Institutional Investors (FIIs) have reversed their strategy, emerging as significant buyers with investments totaling approximately Rs 20,000 crore in the last fortnight, as stated by V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services. This surge in investment is driving a market rally, notably in sectors like banking and IT, which had previously been underperformers. Over the past two weeks, the Nifty has gained 6%, Bank Nifty 7.4%, and Nifty IT around 11%. The substantial delivery-based buying in these sectors suggests potential resilience. In the ongoing market dynamics, Domestic Institutional Investors (DIIs) consistently outpace FIIs, engaging in strategic buying and selling maneuvers. With favorable global and domestic factors, except for high valuations, staying invested, especially in large caps, is advised, with potential profit booking in mid and small caps where valuations are stretched. The BSE Sensex is presently up 27 points at 71,511 points, with Sun Pharma showing a 1.6% increase.

Key Points:

1. Foreign Institutional Investors (FIIs) have shifted their strategy and become significant buyers, investing approximately Rs 20,000 crore in the last two weeks, including bulk purchases, according to V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

2. The current market rally is led by previously underperforming sectors like banking and IT, which have seen notable gains in the past two weeks. The Nifty has risen by 6%, Bank Nifty by 7.4%, and Nifty IT by approximately 11%.

3. The resilience of the market is attributed to substantial delivery-based buying in banking and IT segments, suggesting their potential to remain strong.

4. Recent market dynamics reveal that Domestic Institutional Investors (DIIs) consistently outperformed FIIs by buying from them when they sell and selling the same stocks back to them at higher prices.

5. Despite high valuations in mid and small-cap stocks, the overall market outlook remains positive due to favorable global and domestic factors. It is advised to stay invested, especially in large caps, with potential consideration for profit booking in mid and small caps. As of Monday, BSE Sensex is up 27 points at 71,511 points, and Sun Pharma has gained 1.6%.

Read also| Nifty Shows Impressive 3% Surge Over Last Two Days

Read also| Market Value of BSE Listed Companies Skyrockets by Rs 8.55 Lakh Crore in a Week