Embattled billionaire Gautam Adani and his aides haven't been indicted under the US Foreign Corrupt Practices Act, an entity of the Adani Group said on Wednesday, pointing out that they faced three other charges that include those on securities and wire fraud that carry with them money penalties.

The US Department of Justice's (US DOJ) indictment filed in a New York Court last week does not mention Gautam Adani, founder chairman of the ports-to-energy conglomerate, his nephew Sagar, or Vneet Jaain in any count related to conspiracy to violate the FCPA, Adani Green Energy Ltd (AGEL) said in a stock exchange filing.

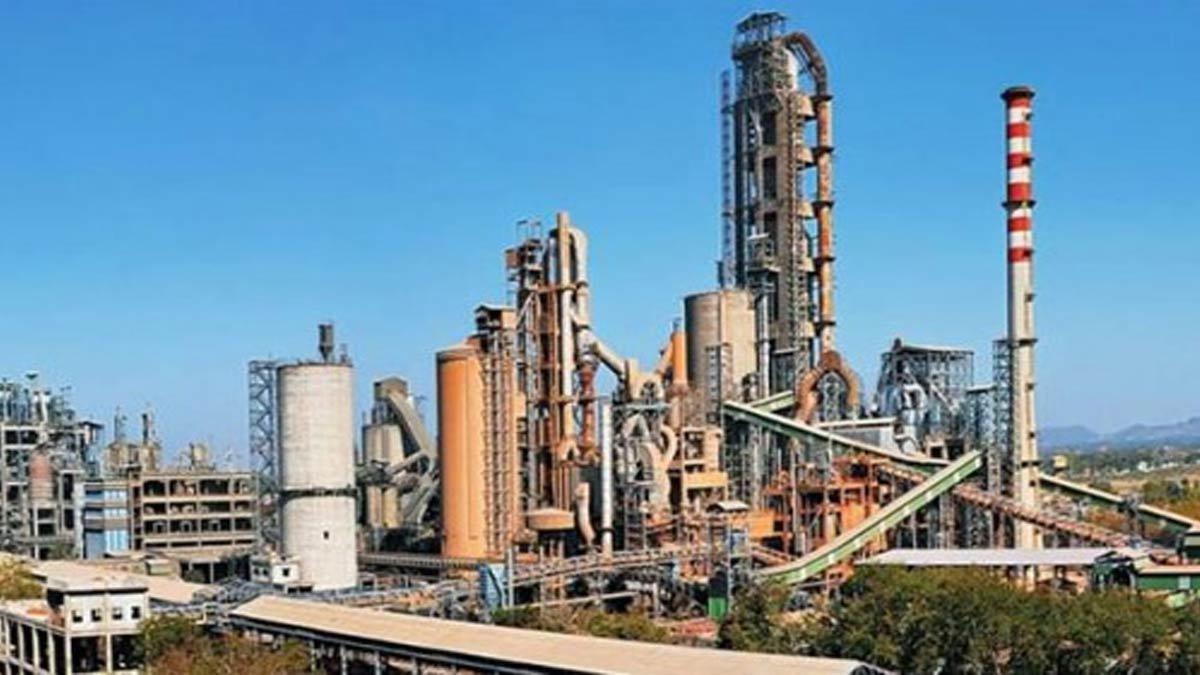

AGEL is at the heart of the allegation of USD 265-million bribes being paid to Indian officials to secure solar power sale contracts that may bring in USD 2 billion of profits over a 20-year period to the firm.

According to the company, the three--AGEL executives have only been charged with securities fraud conspiracy, wire fraud conspiracy, and securities fraud. In general, penalties for such charges are less severe than bribery.

Gautam and Sagar face a civil complaint related to violating sections of the Securities Act and aiding and abetting Adani Green in its violation of the Act, the company said.

The Adani Group last week denied all allegations as baseless, and said it would take legal recourse to defend itself.

The FCPA makes it a crime for a company or person with US links -- such as a public listing, American investors or a joint venture -- to pay or offer something of value to another government's officials for favorable treatment. Although none of the Adani group firms trade in the US, some of them like AGEL do have American investors invested in equity or debt.

"Gautam Adani, Sagar Adani and Vneet Jaain have not been charged with any violation of the FCPA in the counts set forth in the indictment of the US DOJ or civil complaint of the US SEC.".

"These directors have been charged on three counts in the criminal indictment namely alleged securities fraud conspiracy, alleged wire fraud conspiracy, and alleged securities fraud," it said.

US DOJ and US Securities and Exchange Commission issued criminal indictment in the United States District Court, the Eastern District of New York, against Gautam Adani, Sagar Adani, and Vneet Jaain. According to Adani " The Indictment does not even specify any quantum of any fine / penalty ".

Former attorney general and senior counsel Mukul Rohatgi supported the claims of Adani Group saying in his assessment that there are five charges or counts and Adani and his aides have not been charged under Count 1 or 5 which deal with allegations of 'conspiracy to violate the FCPA' and 'conspiracy to obstruct justice' respectively.

Adani and his associates have been framed under other Counts which pertains to securities and bonds.

He said the indictment -- equivalent to a chargesheet filed in an Indian court -- does not name a single person who was paid a bribe.

No offence lies in the indictment against the Adanis or AGEL, said senior Supreme Court advocate Mahesh Jethmalani.

Both lawyers are part of Adani's defence team.

According to the filing, AGEL said in its civil complaint that the executives violated certain sections of the Securities Act of 1933 and the Securities Act of 1934 and aided and abetted AGEL's violation of the Securities Act of 1933 and the Securities Act of 1934.

"Although the complaint prays for an order directing the defendants to pay civil monetary penalties, it does not quantify the amount of penalty," it added.

DOJ has alleged that between 2020 and 2024, top executives of Adani Green, Azure Power and CDPQ, a Canadian institutional investor and the largest shareholder of Azure, conspired to bribe officials of the Indian government to execute lucrative solar energy supply contracts with Indian government entities.

During the same period, senior executives of Adani Green conspired to misrepresent the company's anti-bribery practices (to US-based investors and international financial institutions) and concealed from those investors and institutions their bribery of Indian government officials to obtain billions of dollars in financing for green energy projects, including the corrupt solar energy supply contracts.

Further, high-ranking employees of Azure Power and CDPQ conspired to impair the activities of the US government with regard to their investigations relating to the bribery scheme.

The defendants on Count 1 are Ranjit Gupta, Cyril Cabanes, Saurabh Agarwal, Deepak Malhotra and Rupesh Agarwal. The defendants on Count 5 are Cyril Cabanes, Saurabh Agarwal, Deepak Malhotra and Rupesh Agarwal.

Adani Group companies have lost about USD 54 billion in market capitalisation since the US indictment.

International credit rating agencies, including Moody's and Fitch, have also downgraded their outlook on several Adani firms. These downgrades are based on anticipated increased capital costs and weakened access to funding due to the legal challenges.

One fallout has been the cancellation of raising USD 600 million debt through green bonds by AGEL even though it is subscribed over three times.

DOJ indictment came on exactly the same day, when AGEL had launched its bonds

TotalEnergies, French oil major holding investments in AGEL and Adani Total Gas has stopped new investments in Adani firms.

US International Development Finance Corporation has announced that it is reviewing its USD 550-million port development loan to the Adani-led consortium developing CWIT, a container terminal in Colombo Port. According to the agency, this is being done in the view of assessing the implications of the indictments on the project's integrity and compliance.

Investment firm GQG Partners, which had invested in Adani Group companies as the latter were thrashed over allegations of fraud by US-based Hindenburg Research, has suffered an erosion of value in its holding in the conglomerate.

US investment bank Jefferies, a significant supporter of the Adani Group, is reconsidering its relationship following the charges. This reassessment reflects concerns over reputational risks and compliance issues.

Read also| India's Domestic Air Traffic Grows 5.3% to 1.36 Crore in October

Read also| Centre Approves PAN 2.0 Project Worth Rs 1,435 Crore to Overhaul Taxpayer System