In an age where the internet bridges continents, the digital gambling landscape offers an intriguing peek into the fusion of cultural norms and economic behaviors.

This article takes a deep look into this phenomenon by contrasting the digital wagering scenes in India and Brazil - two nations with distinct cultural identities and thriving economies.

Population Patterns in Online Gambling

In India, the virtual gambling scene buzzes predominantly with the energy of its young population. Over three-quarters of its participants are under 45, with cities like Mumbai and Delhi emerging as the pulsating hearts of this trend.

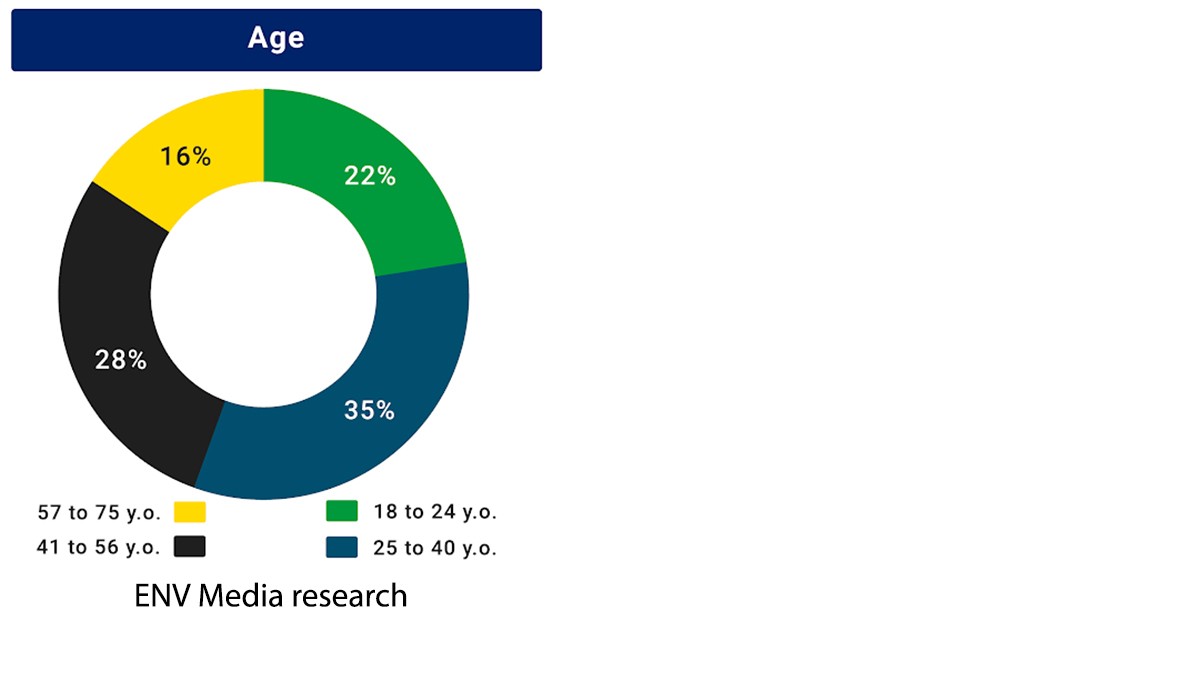

Contrastingly, Brazilian digital gambling is characterized by a more mature crowd. ENV Media’s research indicates the average Brazilian bettor is around 39, with those aged 25-40 being the most active. Predominantly urban, these bettors are primarily concentrated in bustling cities like São Paulo and Rio de Janeiro. Interestingly, despite different cultural contexts, both countries see similar age groups engaging in digital wagering.

Socio-Economic Impact

The story in India is one of stark economic contrasts. The thriving middle and upper classes, especially in economically vibrant regions like Kerala and Punjab, are the main drivers of the digital gambling market.

Brazil's wagering landscape tells a similar tale of economic influence. Wealthier households, particularly those in the A and B economic brackets, are the primary participants in the market. It's intriguing to note that these affluent households, though a smaller segment of Brazil's population, exert a significant influence on the wagering scene.

Monthly Searches Comparing India with Brazil

India’s journey in technology adoption is nothing short of remarkable, resulting in a mobile wagering revolution fueled by affordable smartphones. Brazil mirrors this trend, with a substantial number of bettors preferring mobile platforms, showcasing a seamless integration of technology in wagering habits.

Recently, KTO shared the percentage of which type of device their users play from:

- Mobile: 86%

- Desktop: 13%

- Tablet: 1%

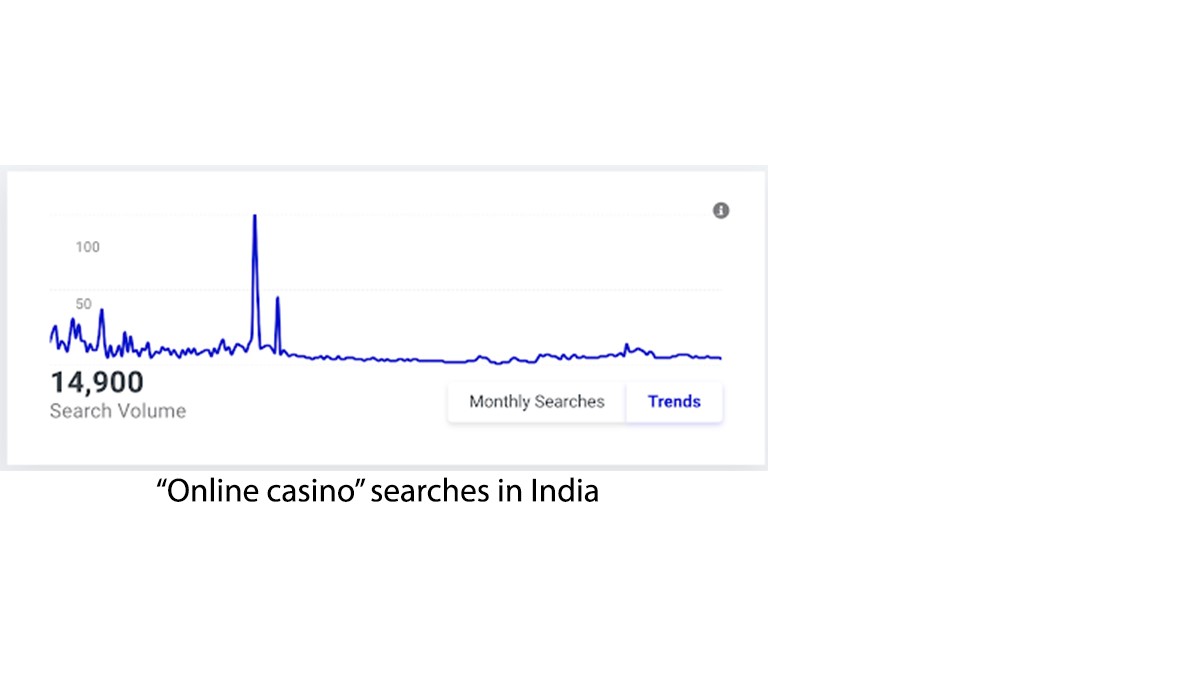

Both nations exhibit comparable enthusiasm for eSports and fantasy sports. Yet, they diverge when it comes to online casinos and sports betting. For instance, "Cassino Online" commands a staggering 160,000 monthly searches in Brazil, dwarfing India’s modest 15,000 for "Online Casino." Similarly, sports betting is far more popular in Brazil, as evidenced by the 212,000 monthly searches for "Aposta Esportiva," compared to India’s lesser interest.

Legalization of sports betting in Brazil has catalyzed its popularity, while in India, such activities remain largely underground due to legal restrictions, hindering online proliferation despite technological strides.

The Brazilian Boom in Digital Wagering

Looking ahead, Brazil's online wagering sector is set for an explosive growth trajectory, due to Brazil recently regulating online gambling. Contrasted with India’s hampered progression due to regulatory constraints.

This paints an interesting picture: despite similar demographic and economic profiles, the future of digital wagering in these two nations diverges, driven by legal and cultural nuances.