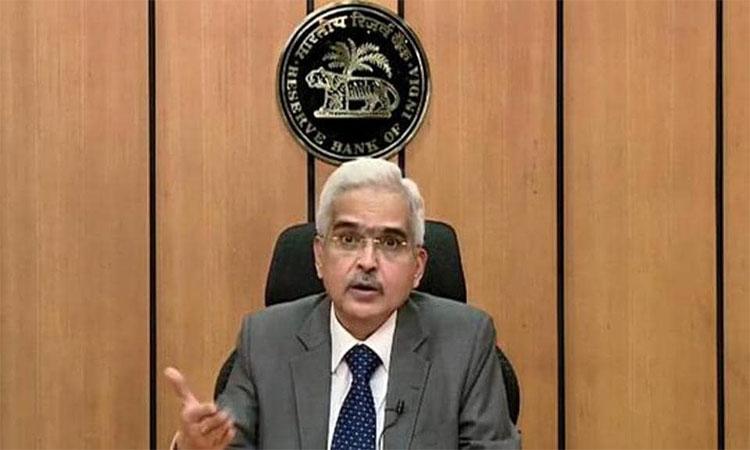

With the rupee witnessing a downward spiral for the past several weeks, even crossing the 83 mark against the US dollar, RBI Governor Shaktikanta Das on Wednesday said that the Indian currency has behaved in an orderly manner and its trajectory shouldn't be looked at emotionally.

Das, while addressing industry body FICCI's banking summit in Mumbai, said that capital flows will resume as the US Federal Reserve will not resort to tightening of rates for a long time.

The RBI Governor's comments on the rupee came just hours before the US Fed is scheduled to meet later in the day to review key rates.

It is anticipated that the Federal Reserve may hike rates to curb rising inflation.

Also Read | Investment in India is about inclusion, democracy & safer planet, says Prime Minister

Meanwhile, referring to the RBI's Monetary Policy Committee's (MPC) scheduled meeting on Thursday to discuss its reply to the government, for failing to keep inflation within its tolerance limit of less than 4 per cent, Das said that the central bank won't immediately release details of the deliberations.

The RBI does not have the authority to release these details, he said.

The central bank is mandated to keep inflation within the tolerance limit of 2 per cent to 4 per cent. However, its failure to do so for the past nine months, has warranted a response from the Centre.

Defending the RBI's handling of price rise, Das said that acting prematurely on inflation would have exerted a heavy cost on the economy and citizens.

Though he agreed that inflation has not been under control, the RBI Governor at the same time added that the central bank prevented a "complete collapse of the economy by keeping rates lower and stayed away from premature tightening".

Also Read | CBDT proposes common ITR form

Speaking on the Central Bank Digital Currency (CBDC), Das said that RBI wants to iron out all aspects related to it before its launch.

He said that e-rupee launch was a landmark moment in the history of currency in the country and it will transform the way business is done and the way transactions are conducted.

On Tuesday, the RBI had launched a trial of the digital rupee.