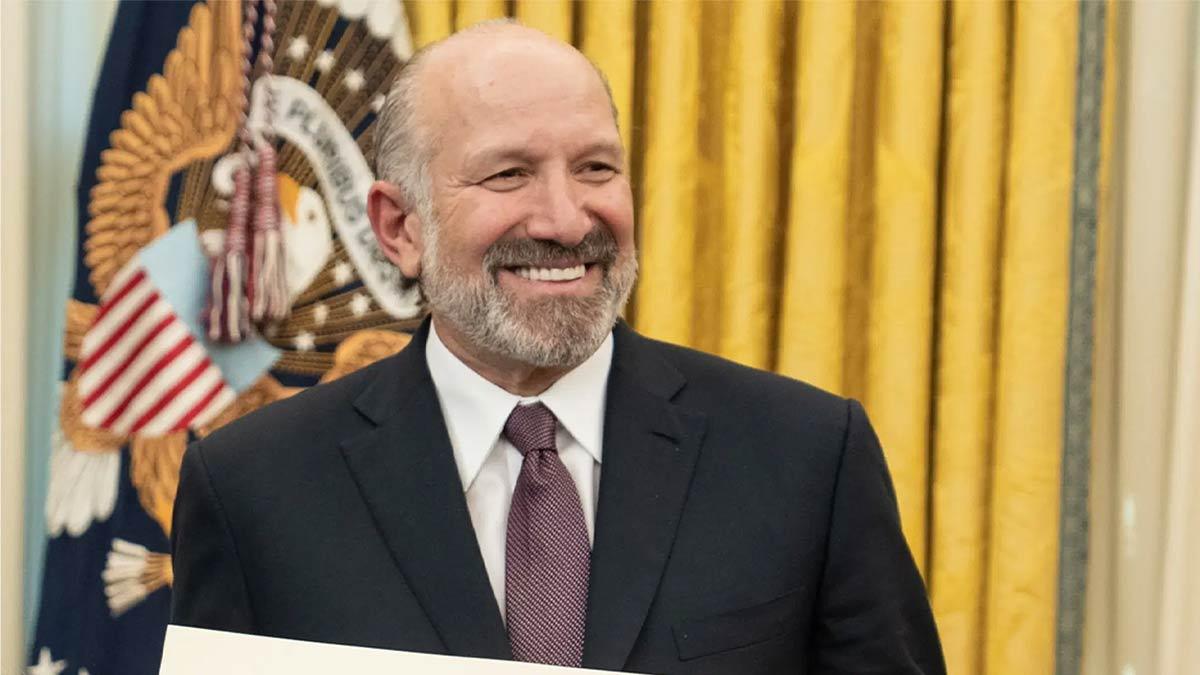

Reserve Bank of India Governor Shaktikanta Das on Wednesday said while the central bank had turned course and taken a softer neutral monetary policy stance to further accelerate growth, this does not mean an interest rate cut at the next meeting.

Addressing a media event here, the RBI Governor said, "A change in stance does not mean there will be a rate cut in the very next monetary policy meeting."

He said that there were still significant upside risks to inflation and "a rate cut at this stage would be very risky".

The RBI, at its monetary policy review, kept interest rates unchanged for the 10th straight meeting but switched its monetary policy stance to "neutral" from "withdrawal of accommodation".

This had led to speculation that the way had been paved for an interest rate cut.

Only when inflation sustainably falls to the RBI's 4 per cent target on a durable basis will measures of relief be considered, Das said.

Inflation rose from 3.65 per cent in August to 5.49 per cent in September owing to rising food prices.

At the same time, Das remains upbeat on the outlook for the Indian economy.

"I would not rush to declare that the economy is slowing down. The data coming in is mixed, but the positives outweigh the negatives. By and large, underlying economic activity remains strong," he remarked.

The RBI Governor cited a robust recovery in car sales during October as a positive sign, though he admitted sales of fast-moving consumer goods in urban areas remained subdued.

Das also said the NBFCs were generally in a healthy state of affair. He noted this was an action by way of regulation taken against just four entities while there existed about 9,400 such NBFCs in the country. This was corrective more than punitive and had helped protect consumer interests, added Das. He further adds that while on the matter of unsecured loans, the banks should not be overtly cautious, yet there are hardly any signs that funds are being diverted to stock markets.

The RBI would not rush to introduce the CBDC, as pointed out by Das, where the pilot projects are at the experiment stage.

He said that the RBI is "still on the learning curve" as far as the digital currency is concerned. "We are not in a hurry to launch the CBDC. We will launch it when we are fully satisfied," he remarked.

The wholesale CBDC, which was launched in November 2022, is used to settle inter-bank transactions in government securities.

Read also| GST Collections Rise by 8.9% Year-on-Year to Rs 1.87 Lakh Crore in October