Maldives Minister of Trade Mohamed Saeed met with Chinese banks on Thursday to discuss strategic partnerships in a bid to revive Maldives' economy. This is after the US credit rating agency Fitch reduced Male's credit rating to junk, describing the nation as doubtful of repaying its foreign debt.

Saeed, who is in China to attend the 15th World Economic Forum in Dalian, sat down with chiefs of the China Industrial and Commercial Bank over current relations between the parties and how to elevate the cooperation to benefit both. He later met with high-ranking officials of the Bank of China.

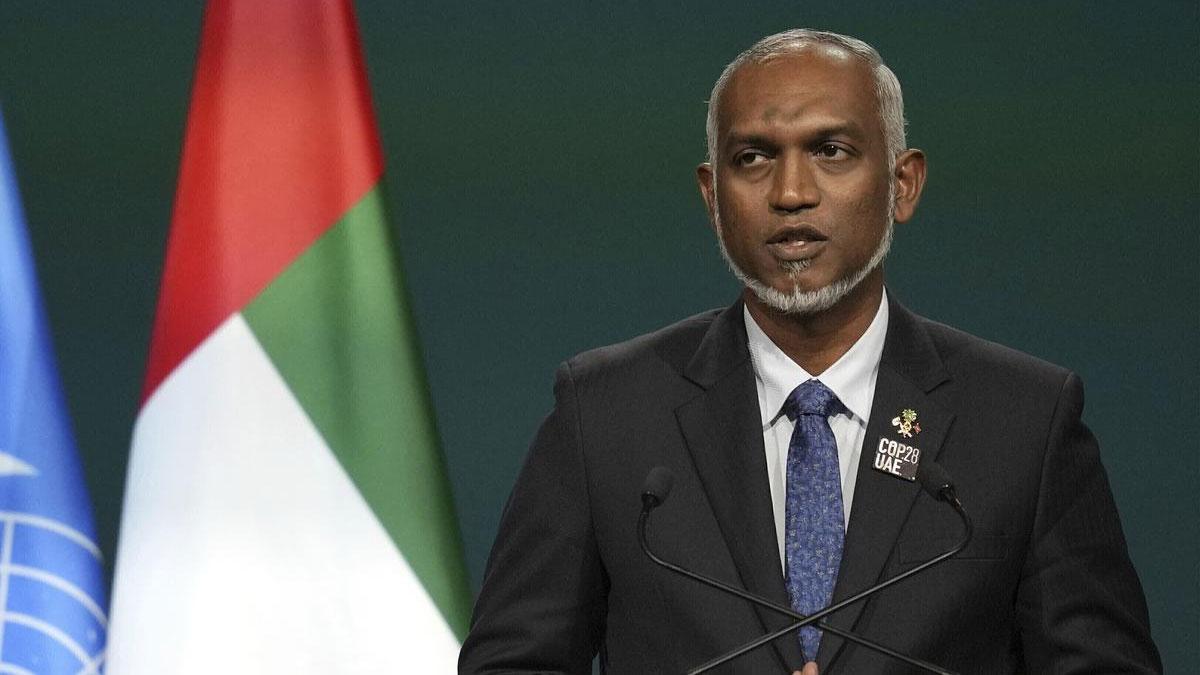

As the Maldivian minister of economic development, Saeed wrote in an X post that following President Mohamed Muizzu's visit to Beijing in January, where he met with Chinese President Xi Jinping, he met with senior executives of the Bank of China "to explore ways in strengthening cooperation between China and the Maldives." Saeed is the first top-level official from Maldives to visit China after Muizzu's state visit.

On Wednesday, the US credit rating agency Fitch cut the Maldives' Long-Term Foreign-Currency Issuer Default Rating to 'CCC+' from 'B-'.

In an accompanying statement, Fitch explained the downgrade: "Fitch typically does not assign Outlooks to sovereigns with a rating of 'CCC+' or below," and observed that the poor rating of the Maldives "reflects increased risks associated with the country's worsening external financing and liquidity metrics." And the agency called attention to the fact that, over the next year, the foreign reserves of the Maldives would remain under heavy pressure. They have already dropped to USD 492 million in May 2024 from USD 748 million a year ago, which was a pointer to a high current account deficit continuing.

Weaker external buffers, according to Fitch include: "The Maldives Monetary Authority's continued interventions to support the currency peg; the repayment of USD 100 million swap arrangement with the Reserve Bank of India in December 2023 and gross foreign reserves net of short-term foreign liabilities was well below USD73 million."

"It noted that the Maldives faces USD 233 million in sovereign external debt-servicing obligations and USD 176 million in publicly guaranteed external debt-servicing obligations due in 2024." The rating commentary by Fitch mentioned that these are set to rise to USD 557 million in 2025. They are likely to cross USD one billion in 2026 alone.

On the other hand, Maldives' foreign debt, according to an official data from 2023, is over USD four billion. Of this, USD 1.5 billion is reportedly owed to its largest lender, China.

Saeed met visiting Chinese Minister of Commerce Wang Wentao on Wednesday to discuss a free trade pact, FTA signed between Maldives and China, but there wasn't any discussion of any type for debating about the Maldives' request to China in regard to debt restructuring:.

Last month, China's ambassador to the Maldives, Wang Lixin, told reporters in Male that China would not agree to debt restructuring because it would affect Male's credit rating for new loans.

The Maldives is an internationally recognized resort destination, and tourism caters to the greater portion of its foreign exchange earnings.

It is the fear of the analysts that, just like the 2022 sovereign default by Sri Lanka, it might push the Maldives into such a development if debt restructuring is not advocated.

Read also | RBI Governor Forecasts India's Consistent Path to 8% GDP Growth

Read also | India's External Debt Ratio Declines to 18.7% by March 2024