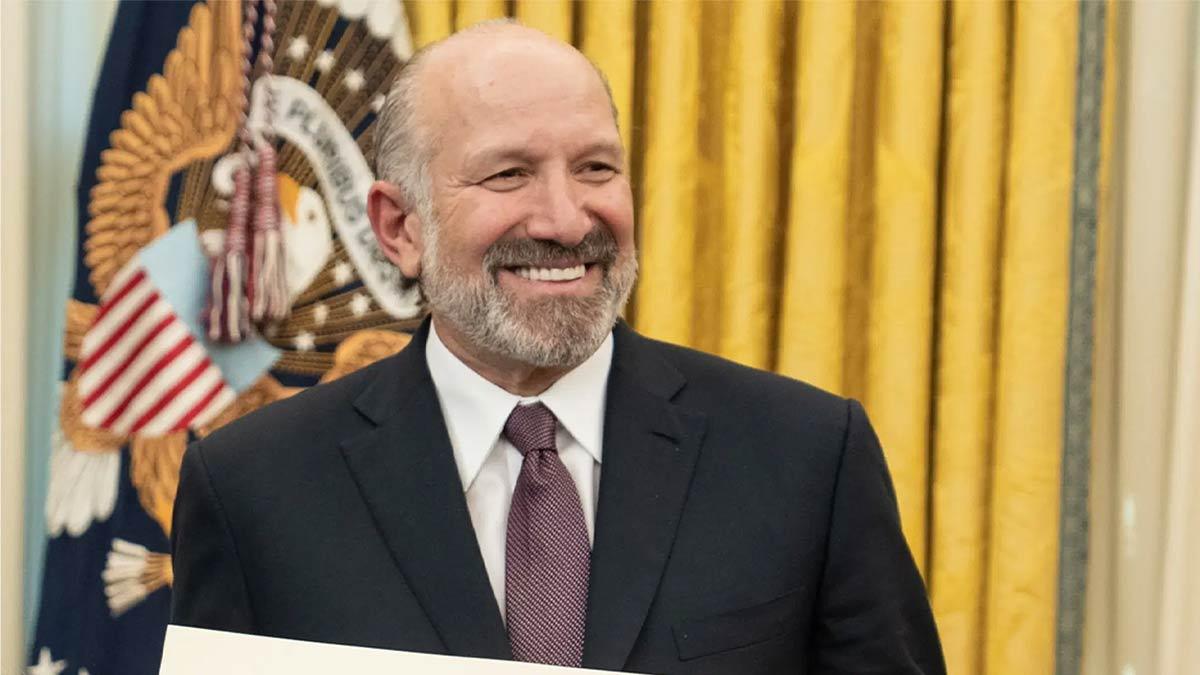

Domestic equities on Wednesday witnessed selling pressure amidst intensifying conflict in the Middle East and worries of a prolonged high-interest rate regime after a better-than-expected US retail sales, says Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

Nifty opened flat but soon drifted into red and closed near day's low at 19671 levels with loss of 140 points (-0.7 per cent).

Broader market too fell with Midcap100 and Smallcap100 down 0.9 per cent and 0.3 per cent respectively.

Except Auto and Pharma, all the sectors ended in red. Bank Nifty was the biggest loser with decline of 1.2 per cent. Pharma sector saw buying interest given its defensive nature and on expectation of healthy earnings delivery, he said.

Going ahead, the market may witness pressure in near term as the commodity prices of Brent crude and gold surged to 1-month high while US 10-Year bond yield spiked to 16-year to above 4.8 per cent. Investor sentiments would be subdued till the tension between Israel-Gaza subsides. But we expect stock specific actions to continue as more and results get declared, he added.

Tomorrow (Thursday) FMCG would be limelight as heavyweights HUL, ITC & Nestle would be declaring their numbers. Midcap IT companies too would be in focus with Cyient, Coforge & Mphasis numbers due tomorrow while Havells and Voltas Q2 results would keep action in consumer durables, he said.

Vinod Nair, Head of Research at Geojit Financial Services said profit booking ensued in Indian markets, spurred by weak global sentiments and escalating Middle East tensions. A sudden rise in the tension has led to instability in energy prices; Brent prices rapidly rose above $92.5 by the day’s closing time.

While the US bond yields was cautiously placed, awaiting the FED chair’s speech. The initial Q2 earnings disappointments by the IT & financials sector may have prompted attention in the domestic markets. All these all factors are presumed to be a knee jerk reaction as the total outlook on domestic market is stable, underpinned by healthy Q2 result forecast and favourable fiscal position, he said.

ALSO READ | Nifty surpasses 19800 mark on all round buying

ALSO READ | Nifty in choppy trade as geopolitical tensions weigh